How to calculate the cost of borrowing

Effective cost or annual percentage rate uses total finance charges to find the true cost of a loan expressed as a percentage rate. The statement above is as of 6212017 with a value date of 6202017.

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

UK Debt stats as of April 2015.

. 24 x 35 84 cents per hour. Let us create a spreadsheet with 4 columns. The higher the inflation rate the higher interest rates rise.

By Sam Swenson CFA CPA Updated Jul 11 2022 at 933AM Image source. Managers will invest only in projects or other assets that will produce returns in excess of the cost of capital. Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan.

Since interest is deductible for income taxes the cost of debt is typically shown as an after-tax percentage. The short answer is that your cost of money is the weighted average of your borrowing and deposit interest rates. While borrowing more money may lead to a lower WACC a high debt-to-equity ratio can result in.

Cost of debt refers to the effective rate a company pays on its current debt. 175 Of the 6120 billion credit card debt approximately 725 is interest bearing eg 4437 billion is carried over each month. Typically lenders also add fees to the principal.

1302 billion Unsecured debt. That is because interest earned on money loaned must compensate for inflation. As compensation for a decline in the purchasing power of money that they will be repaid in the.

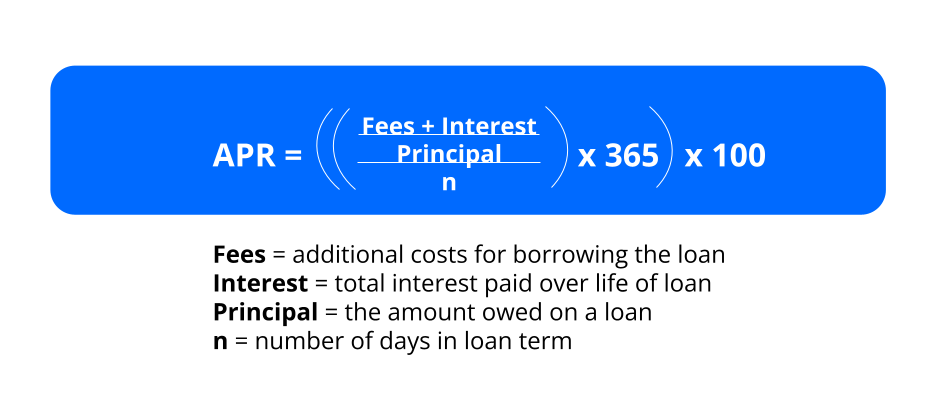

Usually borrowing costs are calculated using the Annual Percentage rate APR. Interest expense is a general term used to describe. Calculate the cost of debt.

Multiply the hourly running cost by the number of hours per day you run the appliance to get a daily running cost. These may be loan processing fees points added to a mortgage or a variety of other charges. Some lenders capitalize unpaid interest - add it to the principal amount of your loan.

Rates are based on a one-day look-back. You can then work out how much you can borrow for a mortgagehome loan. Inflation can benefit both borrowers and lenders.

When this occurs the cost of borrowing decreases due to normal supply and demand economics. The exact cost will be detailed in your loan estimate but PMI typically costs between 02 and 2 of your mortgage principal. Calculating the Cost of Borrowing Stock at Interactive Brokers.

6120 billion Average credit card APR. Taking to social media Lewis told his 17 million followers to work out their new bill over the year multiply the current cost of energy bills by 65 which includes the 400 discount paid. What is the cost of living in Sydney Melbourne or in a regional town.

The living expenses calculator compares the average cost of living in Australia. But renting comes with interest. Renting equipment can be a great way to generate income for your business without committing to a huge upfront expense.

Calculating what your monthly rental will cost means adding interest to the cost of the copier after dividing it. Want to calculate how much a cash advance would cost you. Use our Income Tax Calculator to calculate your tax payable and net income.

Multiply the input power by the energy tariff to calculate the hourly running cost. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. Companies calculate their cost of capital to determine the required return needed to make a capital budgeting investment worthwhile.

Inflation occurs when there is a general increase in the price of goods and services which leads to a fall in the purchasing value of money. Usually interest rates for finance costs are not published by the Companies. Be sure to check with your lender before borrowing or look at ways to pay down the interest before it capitalizes.

The third step of calculating the WACC in excel is to find the Companys cost of debt using their borrowing rate and effective tax rate. As a result FASB. Oftentimes PMI can be waived once the homeowner reaches 20 equity.

4 Simple Steps to Calculate the Cost of Money for Your Small Business. Once you find that information plug it into this equation. In the next section I will explain how to calculate your cost of money in 4 simple steps.

Hence the investors use the following formula to. Oakland Community College maintains a low tuition rate typically one-quarter to one-half the cost of similar public or private higher education institutions -- with support from the state of Michigan and Oakland County. Calculate the cost of equity.

Which means that the UK is paying around 645583500 every month in credit card interest thats. Your first step is going to be pulling out your credit card contract and locating the interest and fees your lender charges for a cash advance. Your monthly interest owed the amount youre borrowing x APR100365 the.

Learn about and calculate the cost of borrowing money. 10 x 84 cents 840 cents a day. Added together interest and fees make up your finance charges.

Borrowing cost calculations should be. This could increase your total loan cost. One of the most common questions people have regarding ASC 842 IFRS 16 and GASB 87 the new lease accounting standards relates to the appropriate discount rate to use in accounting for the arrangementThis specific issue was recently identified as one of the biggest areas of confusion for companies adopting ASC 842 Leases.

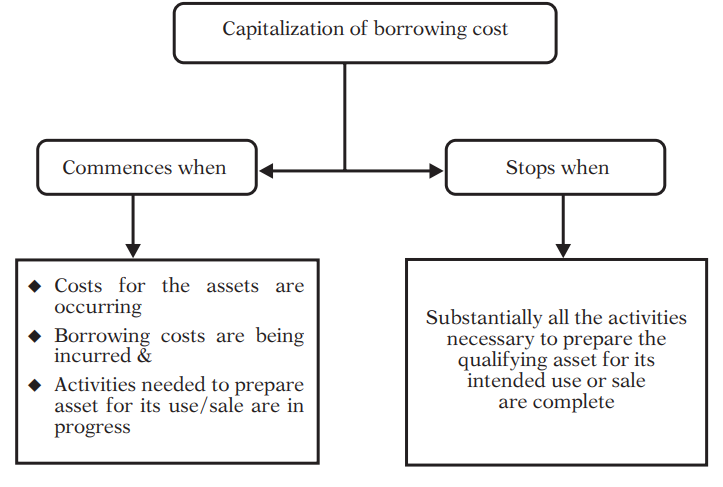

The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator. Calculate the amount of borrowing costs to be capitalised on June 30 2015 in accordance with the requirements of International Accounting Standards. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan.

Total borrowing cost to capitalize in 20X1. 169 billion Credit card debt. Instead of borrowing money students can choose the Federal Work-Study FWS Program that provides part-time work on.

If the appliance is turned on 10 hours per day. Calculation of Financing Cost with Examples.

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Borrowing Base What It Is How To Calculate It

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

Interest Rates Different Types And What They Mean To Borrowers

Understand The Total Cost Of Borrowing Wells Fargo

Cost Of Debt Kd Formula And Calculator Excel Template

What Is Annual Percentage Rate Apr Zillow

Pin On Financial Education

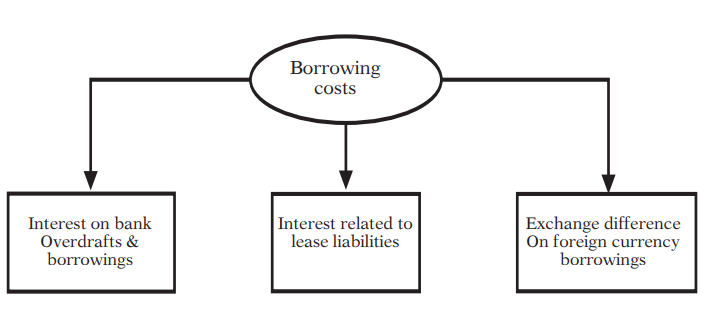

What Is Borrowing Cost A Complete Guide On Ind As 23

Cost Of Debt Kd Formula And Calculator Excel Template

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

What Is Borrowing Cost A Complete Guide On Ind As 23

Financing Fees Deferred Capitalized And Amortized Types

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Cost Of Debt Kd Formula And Calculator Excel Template

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans Start Up Financial Analysis Starting A Business

Pin On Go Math 16 1 Grade 8 Answer Key